Disgraced ex-NY-27 representative back on Twitter

Please join me as I discuss my experience in politics, business, and prison. What do you all want to hear about? #businesscoach #BusinessNews #PrisonReform #prison pic.twitter.com/k6nNMnQiKP

— Chris Collins (@realC_Collins) January 27, 2021

Chris Collins, the former Congressman for the GLOW region who admitted in Federal Court to illegal insider stock trading and lying to the FBI, has reemerged publicly after being pardoned last month by former President Donald Trump.

Collins has started a new Twitter account under the handle @realc_collins. In his first tweet Collins posted a video explaining that as a businessman, politician, and former convict, he is ready to share what he's learned with the social media world.

"I have a lot to share with my many years of experience in the business world, the political world, and just current affairs," Collins said. "I hope you will join me on my various social media platforms and we can have a communication going forward."

Collins represented Genesee County in Congress from 2013 to 2019. He was the first member of Congress in 2015 to endorse Trump for president.

Following an FBI investigation in 2018, Collins and his son, Cameron Collins, were arrested Aug. 8, 2018. The senior Collins was accused of tipping Cameron to a failed drug trial for a publicly traded company that Collins served as a board member. Cameron and other associates then began dumping stock before the news of the failed trial was made public.

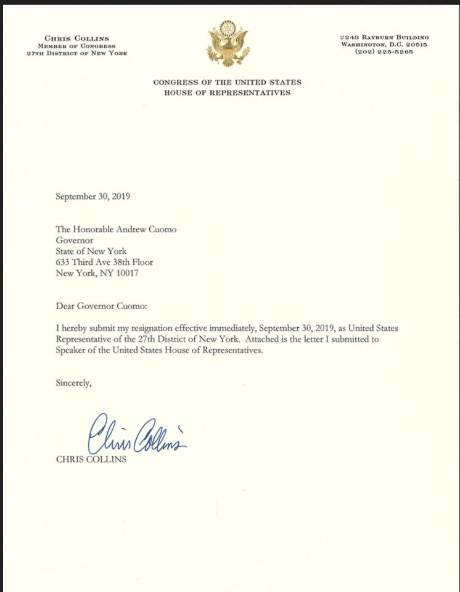

For months, even while running for reelection, Collins denied any wrongdoing and vowed he would be vindicated at trial and then in September 2019, he resigned from Congress and entered a guilty plea in Federal Court.

In January 2020, Collins was sentenced to 26 months in prison. His term was delayed because of COVID-19 and his incarceration in a Federal prison in Florida didn't begin until October. Two months later he was released after being pardoned by Trump.

These are my 5 I’s for the #DepartmentOfInJustice #DOIJ

1. Incompetent

— Chris Collins (@realC_Collins) January 28, 2021

2. Inefficient

3. Insensitive

4. Indifferent

5. Inhumane