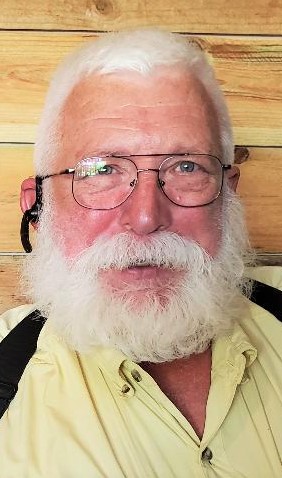

Post, (photo at right), in providing The Batavian his first update on budget proceedings, said the preliminary General Fund spending plan for next year is currently at $4,845,357, which includes $1,346,403 in expenditures for the Highway Fund.

While the General Fund budget is up by about $800,000 from 2021 and the town’s revenue decreased, the Town Board is looking at using $1.18 million in unexpended fund balance ($600,000 more than originally anticipated) to keep the property tax levy at the same level, Post said.

The current tax levy on the books for 2022 (the amount raised by taxes) is at $1,236,000 – the same as the number in 2021.

“Which means that because of the increased assessed value (in the town), the tax rate will go down by about 12 percent – from $2.85 to $2.51,” Post indicated. “Nothing is set in stone as we still have several weeks to work through this and we may tweak it prior to adoption.”

The sewer rate is expected to remain flat at $7.09 per 1,000 gallons used, while the water rate for both residential and agricultural consumers is projected to increase by 2 percent – to $6.32 and $5.12 per 1,000 gallons, respectively.

Meanwhile, the fire district tax rate looks as though it will remain flat, but will result in greater revenue due to the increased assessed valuation.

The Town Board has scheduled public hearings on the sewer and water rates for 7 p.m. Nov. 3 at the Town Hall on West Main Street Road, with a public hearing on the budget to follow at 7:10 p.m.

A special meeting to adopt the budget, and the sewer and water rates is set for Nov. 17 at the Town Hall.

Additional details provided by Post are as follows:

- The strategy on the tax levy “was to keep this as flat as we can, and use up the residual money saved during COVID to purchase the things that were deferred from the last two years,” he said. “Now that we’re in full operation and projects are happening, we need to have the staff and the means to attend to that so we can continue to be in a growth mode.”

- The town is hiring another highway department employee and a “project manager” engineer to assist with administration of Park Road Reconstruction Project. “This is similar to what we did five or six years ago,” Post advised. “When the work increases, we add staff, and when the work decreases, we reduce staff.”

- The plan includes spending about $500,000 on a fleet of pickup trucks, something that was deferred due to COVID. “But we might not even be able to buy trucks next year because they might not be available yet; trucks are hard to find,” Post said.

- The town realized a surplus last year of $280,000, enabling it to use more of its unexpended fund balance, Post reported. “That was due to the efforts the staff has made to find creative ways to finance projects and get grant money to subsidize the operations,” he said. “Through this process, we still have adequate reserves and unexpended fund balances to carry us through whatever the next Apocalypse is.”

- The board is considering pay increases averaging 3 percent, although not across the board, Post said. “That doesn’t mean that money gets spent. Those numbers are not finalized and set until the first of the year. This virtual situation has found a number of efficiencies and it has also allowed the town to service building permits, applications and plan reviews as well as administer public sector projects like Ellicott Trail and repaving and now Park Road and Route 98 improvements.