A change in federal tax law in 2017 could help attract Downstate investors to Upstate communities such as Batavia and the Batavia Development Corporation is planning on pursuing those dollars for economic development in wards three and six.

The new tax law allows investors who have realized profits from prior investments, known as capital gains, to defer and reduce capital gains taxes on those profits if they invest those gains in economically distressed neighborhoods.

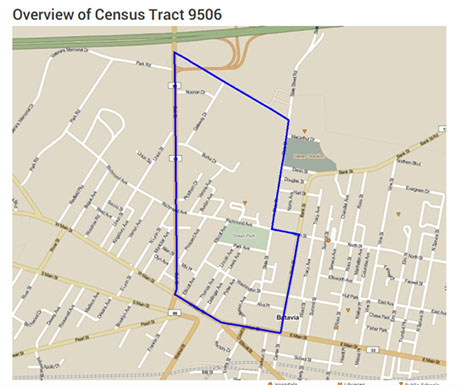

Wards three and six -- which contain the City Centre mall and the Harvester Center, among other distressed properties -- were previously designated Opportunity Zones by the City of Batavia and would be eligible to attract investment under the terms of the revised Federal Tax Code.

Rachael Tabelski, BDC director, asked the City Council on Monday night to approve at its next business meeting a resolution that would allow the BDC to invest $20,000 in setting up a Batavia Opportunity Zone investment vehicle.

"These wards are distressed and would benefit from both large and small investment projects," Tabelski said.

The goal is to attract $5 million in investment funds. Tabelski said there are already potential investors Downstate who have expressed an interest in such investments.

Urban Vantage LLC, a Buffalo-based urban planning firm, would assist, including financially, in setting up the investment package.

The $20,000 would come from BDC's revolving loan fund, which has a current balance of $319,000.

At its next business meeting, the City Council will also be asked to approve a resolution that would allow the revolving loan fund, first established with Federal grants in 1997, to start assisting small businesses in Batavia with cash grants (in addition to continuing revolving grants).

Tabelski told the council that the purpose of the fund is to get money into the hands of local businesses to help spur economic development and the fund isn't accomplishing that goal if the money isn't being put to use.

The $20,000 initial investment would be used for legal preparation of the investment vehicle, listing and marketing the project, along with filing and accounting fees.

"We're setting this up so we are on the map as a proactive community taking advantage of a new federal tax law that is allowing investment into low-income census tracks and to show investors and developers that we're serious about moving our sites forward and creating our own fund as a city," Tabelski said.

There's much about how the new investments will work that hasn't yet been determined by the Treasury Department. The final guidelines should be released in a few weeks.

In general, the idea is if an investor has capital gains, the investor can move those funds to an opportunity zone investment fund and defer any capital gains tax until 2026. After five years, the basis of their taxable gains would be reduced by 10 percent. For example, if an investor had $100,000 in capital gains and invested those gains in an opportunity zone, the investor would owe taxes only $90,000 of those gains. After 10 years, the basis would be reduced another 5 percent.

Also, after 10 years, the investor would not owe any taxes on any additional gains on their opportunity zone investments. In other words, if that investor put $100,000 into an opportunity zone and at the end of 10 years, exited the investment and got back $150,000, there would be no capital gains tax on that additional $50,000 realized from the investment.

"It's really designed to attract investment in projects that have a high likelihood of appreciation," said Richard Rogers, a principal in Urban Vantage.

Tabelski first met Rogers and his partner Travis Gordon during the Downtown Revitalization Initiative process, when they represented Ken Mistler on the Carrs Reborn project. They worked together on developing a plan to create the opportunity zones under the tax code revisions.

Tabelski and Gordon both said Batavia could be attractive to investors not just because of a break on capital gains tax but also because of other credits available, such as historic building tax credits, new market tax credits, and the availability of PILOTs (Payment In Lieu Of Taxes) on building improvements.

"This is a marketable location for people from places like Downstate to put the money into to actually get a good return on their investment as well," Gordon said.

The BDC-initiated fund will focus on real estate investment but there's no reason private investors can't establish their own funds to support business startups and expansions. So long as the business is based in designated opportunity zones, investors would be eligible, potentially, for the same tax breaks on capital gains.

There are some guidelines yet to come yet, however, that will either expand or limit those opportunities. For example, initially, the tax code would have required at least 50 percent of a business's revenue to come from within the opportunity zone.

That would seriously limit, as Rogers noted, a new firm's ability to scale, which would make a much less attractive investment for venture capital.

Tabelski said there is already an investment fund established in Buffalo that might be interested in projects in Batavia.

Photo: Rachel Tabelski presenting the project to the City Council on Monday, accompanied by Richard Rogers and Travis Gordon.

Grants, which are public

Grants, which are public money, being given to private business is not a good idea. Lend the money as they do now, but to give our money away is not.