Le Roy Central School District is planning to increase the tax levy by $66,000 after calculating how much state aid the district can expect to help cover its $27,708,988 spending plan.

The good news for residents of Stafford, who this year reportedly saw a substantial increase in their property assessments, is that if the numbers hold, their property tax rate for public education will go down about $2.37 per $1,000 of assessed value. The anticipated rate is $19.80. That's 13 cents more than it would have been had the Board of Education decided to balance the budget with reserves rather than increase the levy.

Property owners in the district in Pavilion, Bergen, and Caledonia are also looking at a projected tax rate of $19.

However, property owners in the Town of Le Roy pay the same rate they did this year, $24.14.

State law requires that all property owners in a district share the burden of education equally so a formula will be applied to Le Roy's tax rate to make it equitable.

Business Administrator Brian Foeller presented anticipated revenue numbers to board members at a Monday afternoon meeting and then all members of the board participated in a discussion about the tax levy before reaching a consensus decision (no motion nor vote was required) to raise the levy by $66,000.

These are all estimates because final assessment numbers will not be available until July, which will affect the total tax levy.

The tax levy is the total amount of revenue raised through property taxes. The tax rate is the amount per thousand of assessed value that property owners are billed to pay into the levy.

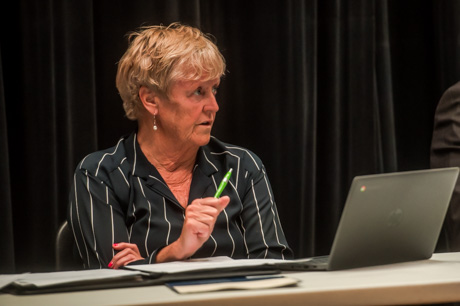

Board President Jacalyn Whiting (top photo) said she was confused by the Town's decision to forego assessment adjustments this year given the state's required equalization rate and that the town must eventually get assessments up to 100 percent of fair market value.

"How is this going to make things better?" Whiting said.

The spending plan is covered by $16,135,963 in state aid, $10,663,025 tax levy, and $910,000 in local revenues.

Local revenues are:

- Fund Balance carried forward

- PILOTS

- Late taxpayer penalties

- Out of district tuition paid by other schools

- Interest earnings of investments

- Medicaid

- BOCES Refund

Budget increases include:

- Professional support and staff salaries, $364,963

- Special Education out-of-district tuition, $282,000

- Staff health insurance, $150,721 (a 12.5 percent increase)

- Grounds/facilities equipment, $81,000

- Debt payment on existing loans, $56,611

The district is adding one full-time equivalent position, replacing a part-time BOCES employee due to an increase in BOCES attendance.

A part-time BOCES speech therapist position is being eliminated. There is also a reduction in spending on COVID-19 supplies and several retirements, with not all positions being replaced.

"We've done our part to try and keep this in mind with rising costs," said Superintendent Merritt Holly. "It's tough. These are not easy decisions."

Whiting agreed, saying the district has done the best it can to control costs.

"This is hard, because I feel we've done a really good job, even adding $66,000 to the levy to bring it to $2 lower per $1,000," Whiting said. "But the assessment part is out of our control. By the same token, you know, we have to balance out here, too."

One thing helping the district this year is the state increased the amount of state aid, a portion called Foundation Aid, to offset shortages to the district in previous years. The increase is only temporary and the district cannot count on it in the future.

Trustee Jason Karcher expressed concern that without a levy increase, the district will face a steeper hill to climb at some point.

"That's gonna be a shock to the system when, and we don't necessarily know when, that would happen," he said. "That's lovely."

Trustee William MacKenzie agreed.

"Eventually the Foundation Aid is going to go away," he said. "It's going to happen."

Trustee Denise Duthe said she believes the district has a history of being responsible for taxpayers' money.

"I think has always done a good job of keeping things basically straight or just a little bit up, not these kinds of wild gyrations," Duthe said. "Everything costs a little bit more. Keep in mind that we want to be as fiscally responsible as we can but we also don't want to do a giant jump next year."

The budget public hearing is scheduled for Tuesday, May 10 at 6 p.m. in Memorial Auditorium.

The vote on the budget and candidates for trustees will be on May 17.

There are four candidates for three open seats. There are two three-year terms and one two-year term open. The candidates are Peter W. Loftus (Incumbent), Randa Williams, Jason Karcher, and Rachael Greene.

Photos by Howard Owens