Contrary to what city and county leaders said they would have wanted for the type of housing complex in the heart of downtown Batavia, Ellicott Station’s low to very low-income levels are warranted according to the latest housing needs study, says Chris Lankenau of Urban Partners.

While Lankenau did not specifically mention the south side apartment complex, he said, in response to questions from The Batavian, that “it appears there is a need for all of those housing types,” which would include the Ellicott Station project, which has been gradually making construction progress throughout the winter and into spring.

Lankenau and his partner Isaac Kwon presented their study this week as an updated version of the 2018 county housing study in which they took “a deeper dive” into the current for-sale and rental housing markets than most studies, Lankenau said.

This current study used “real-time data that we acquire, while certain demographic and employment trends are gathered from typical sources such as the U.S. Census,” he said.

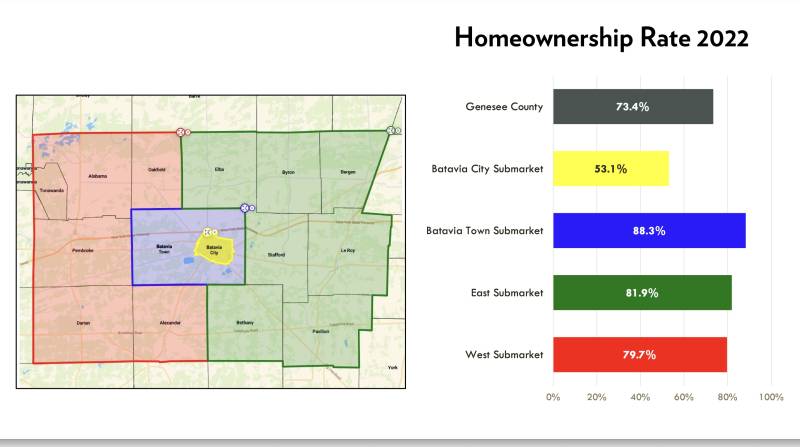

The city of Batavia, though short on home ownership — 53% compared to the town of Batavia at 88% — edged out the other municipalities in showing a slight uptick in housing growth, at .2%, versus the town’s 7% decrease, he said.

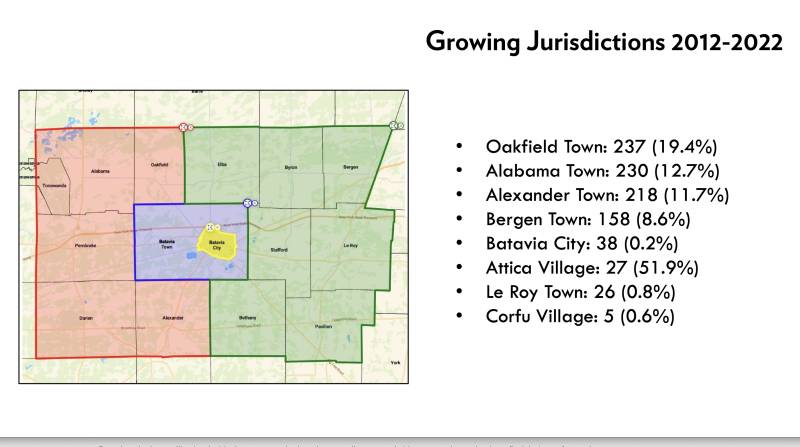

Who’s moving to Genesee County? There's a trade-off, with folks moving in and out of both Erie and Monroe counties, to the tune of more than 250 a year. There were 254 per year, or 21.6%, of all new households in 2021 came from Erie County and 247 from Monroe County, versus 218 that went to Erie County and 279 to Monroe County.

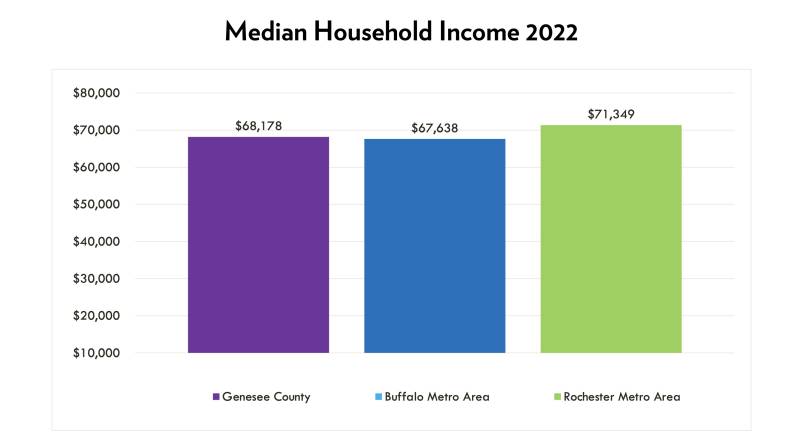

The latest data show that the median household income is $68,178, and housing is considered affordable when rent or mortgage plus utilities are no more than 30% of a household’s gross income, Lankenau said.

Just over 22% of residents were considered “cost-burdened,” with nearly half of them earning less than 80% of the annual median income. Ellicott Station was set up for occupants earning between 50 and 60% of the AMI for low-income households and less than 50% for very low-income households, and Section 8 housing vouchers are available.

Workforce housing, which is 80 to 120% of AMI, according to HUD definitions, is not included in the Ellicott Station project.

Not far from the Ellicott Street complex is the Carr’s Reborn site on Main and Jackson Streets. That will provide the opposite end of the scale with 10 market-rate apartments—which also falls within the needed housing types, Lankenau said. The landlord sets the market rate, and it is not dependent on any type of income level, as a low-income housing unit would be.

“We do think the city is on the right track in this regard. In fact, the city is the only submarket in the study that is increasing both its for-sale and rental housing stock,” he said. “Continuing this trend of expanding housing opportunities that focus on Batavia – the county’s center of commerce and transportation – is a good policy for growth.

“In addition to new construction, we think it will also be important to support the rehabilitation of the county's existing older housing stock, especially in Batavia, to accommodate more homeowners and renters,” he said.

The city has announced programs to supplement qualifying homeowners and developers with grant money for projects that meet guidelines for particular housing types and for improvements to boost the value of one’s property and overall neighborhood.

Gov. Kathy Hochul said Thursday that Batavia was one of 61 local governments that have already been certified for the state's Pro-Housing Communities Program, launched last year as part of a package of Executive Actions to increase the housing supply.

As part of the 2025 Enacted Budget, the governor secured an agreement to require Pro-Housing Community certification for up to $650 million in state discretionary funding.

“Across our state, local leaders are joining our Pro-Housing Communities program to take a stand against New York’s housing crisis and commit to building the homes New Yorkers deserve,” Hochul said in a press release. “My administration is ready to work with any community that shares our determination to build safe, stable, and affordable housing, and I encourage even more local leaders to launch their applications, get certified, and help us achieve our housing potential in every part of the state.”

So it certainly seems that pursuit of new housing is the trend moving forward. Along with that, Urban Partners will be determining more detailed housing needs as part of the next steps of the study. The Batavian asked if and when other elements will be part of the bigger picture, such as zoning, utilities, and availability of land for building.

“We will conduct an assessment of existing and future demand for housing in Genesee County for the next 20 years based on long-term projected growth for the county, detailed in five-year increments,” Lankenau said. “Which will lead to a series of recommended policies and actions to meet those needs. While examining available land, zoning, and utilities in detail goes beyond the scope of this study, we will suggest when and where these factors will need to be addressed to accommodate future housing.”

The Batavian also asked about other works in progress in the towns of Pembroke and Batavia, and how they fit into the study’s findings.

The study discusses the completed part of Brickhouse Commons in the Rental Market section and identifies the future phases of that development as well as the additional new project in Pembroke and Town of Batavia in the Home Building Activity section. The total future housing needs quantities will take into account those projects under construction or in the development pipeline.

During the past five years, 2022 was the hot one for home sales, with 783 homes sold in the city, compared to 539 in 2019. That has fallen down to 626 in 2023, and now “homes are nowhere to be found,” he said. The median house price jumped from $115,000 to upwards of $200,000, thanks to the continuous ballooning of home sizes, which incidentally haven’t seemed to accommodate either end of the shopper's list: a young family just starting out and looking for something affordable or the senior wishing to downsize, he said.

As for those senior citizens, a survey of 540 people found that 61% preferred to age in place, but of those, 32% said their homes weren’t suitable to do so due to stairs and maintenance issues. Of those respondents, 95% lived in a single-family home and 44% of them have lived there for more than 20 years.

More than a third of those people said they were planning to purchase a new home, which is promising news for realtors, and unsurprisingly, the biggest barrier is cost. Nearly 40% of those answering said that they had difficulty paying for their basic needs.

The Batavian asked how the respondents were chosen and how the survey was administered. It was an online Google document with a survey link provided on the county’s website, he said.

“In addition, we encouraged county staff and key stakeholders to share the survey with colleagues, employees, and all members of their communities,” he said. “Results of the survey were automatically tabulated in a spreadsheet of raw data from which we highlighted specific relevant questions and responses.”

To view the entire presentation, go HERE.