Residents are invited to learn about BCSD's $58.9M budget before vote

You know that old saying, April showers bring May flowers, and, of course, school budget season and related district resident votes.

Batavia City Schools will be reviewing its $58.9 million proposed budget during a public hearing at 6 p.m. Monday in the Superintendent’s Conference Room at Batavia High School, 260 State St., Batavia. This is the time to ask questions, voice comments, or express concerns about the district’s spending plan.

The budget is an increase of $4,168,181 from the prior year, or 7.6 percent, with a related tax levy of nearly $19.9 million. That levy equals an increase of 1.02 percent, or $200,093, district officials said.

Despite a tax levy increase, officials predict that the tax rate will go down by 34 cents per $1,000 assessed property value. Based on that decrease, a home assessed at $100,000 would pay $34 less per year (with no change in assessment from 2022-23 to 2023-24).

Factors impacting the change in the projected tax rate, according to district administrators, including the tentative assessed values have increased slightly at 3.06 percent; equalization rates have decreased slightly, and the tax rate has decreased by 1.95 percent with a levy increase of 1.02 percent.

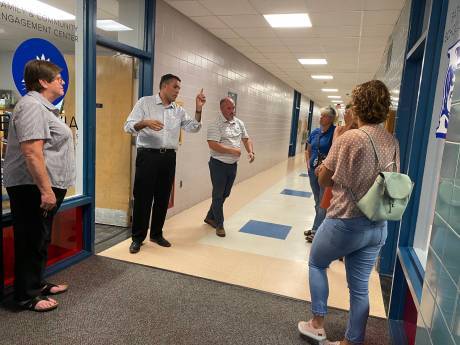

Other key points school administrators want to emphasize are that Robert Morris School was reopened this past year to be used for Universal Pre-Kindergarten and preschool; Community Eligibility Provision was extended through 2025-26; administrators are active in pursuing new grant funding for mental health, Community Schools, pre-school and a 21st Century Schools grant; and they are working on the next capital project.

Important numbers include student enrollment: Grades pre-K are at 72; Grades K through one, 340; Grades two through four, 482; five through eight, 592; and nine through 12, 641.

The average Class Size for UPK is 18; K through one is 17; Grades two through four, 20; Grades five through eight, 21; and Grades nine through 12, 20.

Staff numbers include:

- Total Number of Teachers - 269

- Teacher Aides/Clerical - 140

- Maintenance Staff - 39

- Nutritional Services - 25

- Assistant Principals - 6

- Principals - 4

- Central Office - 7

- Information Technology - 3

Revenue Sources for 2023-24 are:

- State and Federal Aid - $33,174,343 (56.3 percent)

- Tax Levy - $19,888,991 (33.7 percent)

- Other Local Revenue $1,492,750 (2.5 percent)

- Appropriated Fund Balance $3,536,895 (6.0 percent)

- Other Local Tax-related Items $877,795 (1.5 percent)

- TOTAL: $58,970,774 100.0 percent

Appropriation (Expenses) Budget:

- General Support $6,471,769 11.0 (percent)

- Instructional Support $34,372,758 58.3 (percent)

- Transportation $2,753,845 (4.7 percent)

- Employee Benefits $12,501,759 (21.2 percent)

- Debt Service $2,735,643 (4.6 percent)

- Interfund Transfers $135,000 (0.2 percent)

- TOTAL: $58,970,774 100.0 percent

There are four propositions on the city school district’s ballot up for vote:

- The 2023-24 budget approval

- Continuing placement of a student ex-officio on the board

- To fund a capital reserve of up to $10 million

- Election of two board seats due to the terms being up for incumbents Alice Ann Benedict and Barbara Bowman

Voting will be from 11 a.m. to 9 p.m. on May 16 at district residents’ designated polling locations.

A regular board meeting is to follow the budget hearing. To view it online, go HERE.

File Photo of Batavia Board of Education members, with Superintendent Jason Smith, taking a tour of Robert Morris before it opened last year for Universal Pre-Kindergarten and pre-school. Photo by Joanne Beck.