Tompkins Community Bank

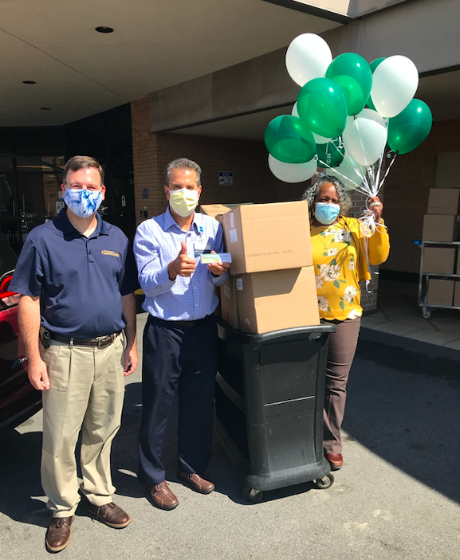

Sweet! Tompkins donates Oliver's Candy Bars to frontline workers at Rochester Regional Health

Submitted photo and press release:

In an effort to brighten the day for local frontline workers during the COVID-19 pandemic, Tompkins Bank of Castile, Tompkins Insurance Agencies and Tompkins Financial Advisors donated 3,400 Oliver’s Candy Bars to the Rochester Regional Health Staff.

The sweet treat will be handed out to all employees as a way to say "Thank You!"

Pictured from left are: Steve Beardsley, senior vice president, Commercial Banking regional manager, presents Jim Creighton and Gina Burden-Rambert of Rochester Regional Health with 3,400 candy bars to distribute to their staff.

More than 700 small businesses received relief loans through Tompkins Bank of Castile

Press release:

More than 700 companies throughout Western New York were able to access approximately $120 million under the Small Business Administration’s Paycheck Protection Program facilitated by Tompkins Bank of Castile.

“Keeping with our longstanding commitment to the community, we were happy to do our part to support local businesses, especially during this time of need,” said President and CEO, John McKenna. “We’re thankful that our efforts were able to protect more than 7,000 local jobs.”

Essential bank staff aimed to get ahead of the rush by working extended hours — mostly remotely — to reassure customers, explain the PPP program, and process the loans as quickly as possible.

Local businesses are using the loans to keep employees on their payrolls, as well as cover other operating costs including interest, rent, and utility costs. The customers were very appreciative of the support.

“We’re grateful for Tompkins for keeping us updated on this process and supporting us along the way,” said one small business owner. “I really appreciate the information they have been able to provide, and I feel very confident with Tompkins at the helm.”

The COVID-19 pandemic required Tompkins to restrict its services to drive-up, ATM, phone, mobile, and internet banking. During this time, the staff worked diligently to educate customers about its electronic services.

“As an essential business, we’ve been fortunate to stay open and accessible to our customers when they need us most,” McKenna said. “We believe in the power of our local people working together to help our communities grow and thrive; That’s why we’ll continue to do everything possible to support our friends and neighbors as we work together to recover.”

Tompkins Bank of Castile to aid its employees affected by COVID-19 pandemic

Press release:

In an effort to assist its employees with unexpected financial burdens faced during the current COVID-19 crisis, Tompkins Financial is offering a discount loan program to non-executive Tomkins employees who have encountered increased expenses or decreased income. These include spouse or domestic partner’s job loss, and unexpected costs for elder care or child care.

In addition, Tompkins has instituted a premium of up to 25 percent additional pay for employees whose essential work requires them to be on-site.

“Banks have been deemed to provide an essential service to our customers and communities and this is a way we can show our appreciation to our employees,” said John McKenna, president and CEO. “We understand that while we as a company are fortunate enough to maintain our workforce during this time, our team members may have spouses or partners who experience job loss.

"We also appreciate that they may experience unexpected costs related to the pandemic. We want our team members to know that Tompkins is standing by them in the same way they are standing by our customers.”

The premium pay model will apply to both exempt and non-exempt non-executive employees whose work requires them to report to a Tompkins location to perform essential job duties.

About Tompkins Bank of Castile

Tompkins Bank of Castile is a community bank with 15 offices in the six-county Western New York region. Services include complete lines of consumer deposit accounts and loans, business accounts and loans, and leasing. In addition, insurance is offered through an affiliate company, Tompkins Insurance Agencies, Wealth management, trust and investment services are provided through Tompkins Financial Advisors. Further information about the bank is available on its website, www.bankofcastile.com.

LIVE: Interview with John McKenna, President and CEO of Tompkins Bank of Castile

We're going to talk with John McKenna, CEO, and president of Tompkins Bank of Castile about programs available to assist small businesses and homeowners.

Tompkins Bank of Castile offers temporary loan assistance program for customers

Press release:

In an effort to assist current customers with unexpected financial burdens faced during the current coronavirus crisis, Tompkins Bank of Castile has implemented a temporary loan assistance program for our customers.

Our new Loan Assistance Program offers two-month loan payment deferment for various loan types, including consumer and commercial loans and mortgages.

“Our commitment to our customers and community continues to be the driving force for all we do,” said John McKenna, president and CEO. “As a community bank, it is our duty to assist our customers when facing unexpected hardship. We’re grateful to be able to support our customers in any way we can.”

Customers who would like to participate in the program will need to contact their banker via phone or email immediately, or reach out to Tompkins Customer Care Center at 1-877-243-8030 to review options that may be available to them. Please visit our website for more information.

Today Tompkins Bank of Castile starts serving customers by drive-up or appointment only

Press release:

In support of NY State’s efforts to slow the spread of the coronavirus, Tompkins Bank of Castile is transitioning to serving customers by drive-up or appointment only as of today, March 19. To make an appointment, customers may call their preferred branch or the Tompkins Bank of Castile Care Center at 1-877-243-8030.

Mobile and Online banking remain available 24/7 for many banking needs, including depositing checks, paying bills, and more. Other service options include:

- Full service 24 hour ATMs

- Night drop depositories (available at most branches)

Customers should be aware that the Gainesville Branch will be closing, and the Amherst branch will be by appointment only. Customers who normally bank at the Gainesville Branch are encouraged to schedule appointments at the Warsaw and Castile offices.

“We are committed to implementing every measure possible to take great care of our employees and our customers, while providing uninterrupted access to your funds,” said John McKenna, president and CEO of Tompkins Bank of Castile.

“We understand the challenges that we all will be facing in the coming weeks, but we want to assure all of our customers that your Tompkins family is here for you. Through the power of our community, our employees, and our customers – we can get through this together.”

The company continues to monitor the coronavirus situation closely, and is following the guidance of relevant authorities, including the Centers for Disease Control and Prevention, the World Health Organization and various state and local government entities. As such, all functions that can be accomplished outside of a physical branch or office location have been moved to a remote environment.

For the most current information on the actions Tompkins Bank of Castile is taking, please visit their website.

Tompkins Insurance Agencies customers are encouraged to call TIA’s Customer Care Center at 1-888-261-2688.

Tompkins Financial Advisors clients are encouraged to contact their advisor directly, or call 1-800-275-4003.

Video: Tompkins Bank of Castile, Business of the Year

Tompkins Bank of Castile is Genesee County's Business of the Year. Tompkins will receive the award tonight during an awards dinner at Quality Inn & Suites in Batavia.