Partners announce new name with ties to historic Batavia for brewery in Newberry Building

Press release:

Three Batavia natives are giving a nod to the city’s past with an exciting plan they hope will be a cornerstone of Batavia’s future.

Eli Fish Brewing Company will be the official name of a microbrewery currently under construction in the former JJ Newberry Building at 109 Main Street, the brewery’s owners announced today. The name is in honor of Eli Fish, who operated Fish’s Malt House, a brewery located on the corner of Elm and Main Streets in the 1800s. The brewery, which reportedly had the capacity to produce 16,000 barrels of beer annually in 1883, burned many times during Fish’s ownership, with Fish rebuilding it each time at the same location.

Eli Fish Brewing Company is led by Batavia natives Matthew Gray, owner of Alex’s Place in Batavia, as well as Buffalo Brothers Pizza and Wing Co. in North Carolina, Jon Mager, a third-generation owner in Arctic Refrigeration in Batavia, and Matthew Boyd, a partner in both Alex’s and Buffalo Brothers Pizza and Wing Co., who oversees Buffalo Brothers’ five North Carolina locations. The owners expect to open Eli Fish Brewing Company by the end of the year.

“Eli Fish was a renaissance man who played an important role in the development and growth of early Batavia, and his entrepreneurial and rebuilding spirit really spoke to us,” Mager said of the decision to name the microbrewery. “That’s the same spirit and vision we want to bring to this project and bring people back to Main Street.”

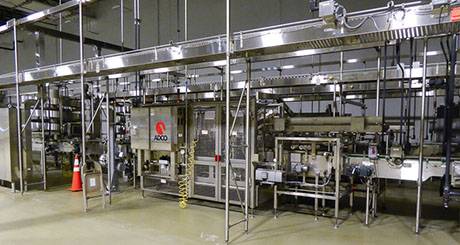

The brewery will house 20 taps, featuring ten beers brewed in-house and ten rotating beers from around New York State. Along with New York beers, the bar will also pour craft cocktails and fine wines, all sourced from New York State wineries and distilleries. The brewery operation will be a seven-barrel system, with all brewing performed on site, using locally-sourced ingredients.

Eli Fish Brewing Company will be the cornerstone of a $2.8 million renovation of the Newberry building into a mixed-use development with a restaurant incubator, known as FreshLAB, joining the brewery on the first floor and apartments planned for the second and third floors.

“Newberry’s was a destination for generations of Batavia residents,” Gray said, recalling the store’s lunch counter and creaky wooden floors. “We want to make this building, and the Main Street corridor, a destination again. Jon, Matt and I were all born here. Our families saw the decline of the ‘70s, ‘80s and ‘90s, and we want to be part of Batavia’s next renaissance.”

The FreshLAB restaurant incubator will feature three commercial kitchens, with Eli Fish Brewing Company operating the largest kitchen and serving a menu of locally-sourced seasonal fare, including gourmet salads, sandwiches, soups, platters and bread. The other two kitchens will be available to start-up restaurateurs to develop and grow more dining concepts within Genesee County. The vision is to have tenants occupy the turnkey kitchens for short-term leases of approximately 18-24 months, sharing the food hall dining room during which time they can focus on unique menu offerings, sourcing local ingredients and honing their operational systems, such as ordering product and paying their bills.

“The idea is to help other restaurateurs and entrepreneurs develop their businesses without the financial burden of outfitting their own locations right off the bat,” explained Boyd. “Once they have perfected their operation and their lease matures, the vision is that they will then plant their roots and continue their operations in Genesee County, creating an opportunity for a new eatery to locate at FreshLAB.”

The incubator concept was fueled, in part, by statistics that show local residents spend more than $13 million annually on dining and nightlife outside of Genesee County.

“People want a choice,” added Gray, who labels himself a “serial restaurateur.” “Every eatery at FreshLAB should bring a fresh perspective and their own culinary vision to the kitchens. We’re looking to provide a culinary experience you can’t enjoy elsewhere in the area.”

The partners’ development vision for the Newberry building is being supported by the City of Batavia, Batavia Development Corp., Genesee County Economic Development Corporation, USDA Rural Development, National Grid and New York Main Street.

The announcement of the Eli Fish Brewing Company name comes as beer lovers from throughout the region prepare to celebrate the Beertavia craft beer festival on Saturday, August 12 from 3-6 p.m. at the corner of Bank Street and Alva Place. The event, presented by Alex’s Place, will feature offerings from more than 20 breweries and cideries, as well as live music. Information is available at www.downtownbataviany.com.