Culinary Institute grad to add breakfast, lunch, bread, dessert -- 'a little bit of all of it' to GO ART! bakery

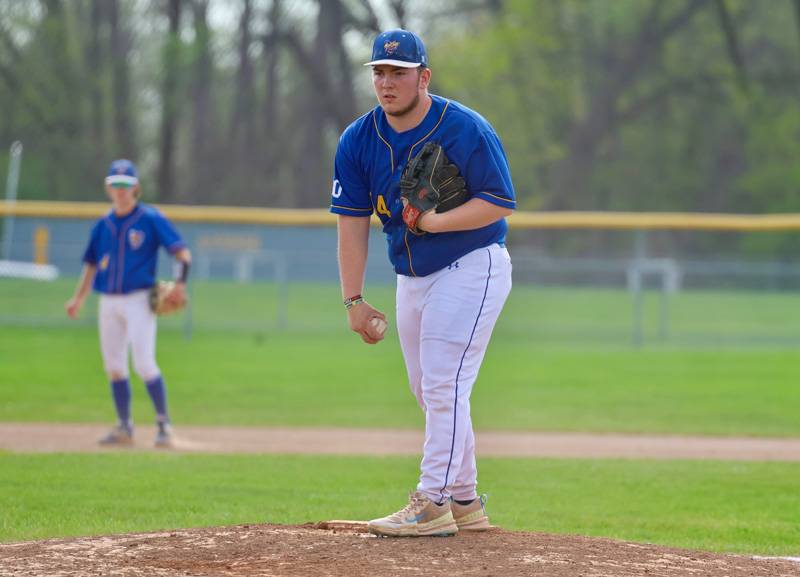

Photo by Howard Owens

What are the odds of two bakers with the same last name applying for a position at GO ART!’s Audrey 2.0.1 Bakery at Seymour Place? As it turns out, the odds were in the arts council’s favor, and both landed a sweet — and savory—spot in the fully equipped kitchen at 201 E. Main St., Batavia.

While Kiel Green opened up shop at the bakery last September as part of an Artist Incubator Program to hone his skills, Grace Greene also sent in her resume for a position as she was completing her degree at the Culinary Institute of America. One could say she brought her CIA game.

“So, I actually originally applied for just the baking position, and (Executive Director) Gregory Hallock ended up seeing my resume after they had hired the last person. And so he ended up being like, 'Hmm, you know, maybe she can take on a little bit more.' So they ended up welcoming me in and starting a new job description, basically. So I kind of am overseeing everything in the kitchen as well as I'm going to eventually make it into the bar area and work on some mixed drinks and specialty items on that side of things too, because I took a mixology, a wines class and a beer-making class at school, so I have a background in a little bit of all of it,“ Greene said on her first day open Thursday. “We'll definitely have the sandwiches next week, and then we'll probably tack on one at a time in the following weeks. And then I'm also working on a breakfast menu for Saturdays, so we'll have things like waffles, pancakes, breakfast sandwiches, avocado toast. And then I'm also going to make fresh doughnuts every Saturday as well. So we'll have a few different options, and then hopefully a specialty.”

Greene, who moved back to Rochester after finishing culinary school in Hyde Park, obtained her bachelor’s in professional studies with a concentration in baking and pastry. She graduated on April 16 and made a quick move back in with family to take this job, with the intention to move closer by the fall, she said.

The 25-year-old did a lot of hands-on training, working in a bakery and for a large restaurant in Poughkeepsie, she said, finessing handmade dough into stuffed dumplings by being in charge of making 700 pierogi each week. (So don’t be surprised if this Polish specialty makes it on the menu eventually.)

For those who have missed the aroma and taste of fresh baked bread, that’s “my favorite thing,” she said: a tall, airy house focaccia with sautéed onions and garlic, and her own version of a glaze-topped cinnamon roll focaccia, brioche, rustic baguettes, ciabatta, sour dough and a rye sour. They will be available for purchase and as the base for future build-your-own sandwiches with assorted meats, cheeses, and toppings, a turkey club, and bruschetta topped with tomatoes, onions, olive oil, salt, pepper, and then topped off with fresh mozzarella.

What is it about making your own bread?

“It’s really just, since it is so hands-on, relative to other things, finally getting that product and seeing what you made with your hands, is just great to see,” she said. “It’s a lot of waiting around, it's on its own time, you can't rush it. I feel like a lot of times, people don't let it, at the very end, proof long enough, and that's when you get it popping out and all that kind of stuff. So it's really a hurry up and wait kind of thing.”

Soups will begin with a chicken noodle and perhaps a cheddar broccoli, garden vegetable, or classic Caesar with homemade croutons for salads, with homemade dressings. For the sweet tooth? Large sugar cookies, cakes, brownies, brookies — a crunchy creamy combination of a chocolate chip cookie layered with Oreos in the center and topped with brownie mix — muffins, cupcakes, special orders of decorated cakes, cupcakes, the increasingly popular Rice Krispie treats, cake pops, and bridal or baby shower dessert boxes, and that's probably not even the exhaustive list, as she will work with customers for special requests.

There will also be espresso and regular drip coffee, decaf, French roast, and latte drinks with — you may have guessed it — house-made caramel and chocolate sauces. Speaking of made in-house, Greene will be whipping up her own butter for the bagels, waffles and pancakes.

She plans to tack on Sundays to the three-day schedule at some point as part of future expansion of hours and days “as things go forward.” Other goal are to: work with some culinary arts students from Genesee Valley BOCES to allow them hands-on experience and offer more variety to the community as they learn. There are likely to be cake and cupcake decorating classes for adults and children, and more opportunities “to have people in the kitchen” learning, she said.

"There's actually a couple of students over at the BOCES program who we were thinking about bringing in kind of as a mentorship or part-time work. One of them is very much into adapting recipes and making them healthier by substituting flours and sugar types, and all kinds of things. So I have a background in all of it," Greene said. "But the one thing with school is, basically, every three weeks we'd switch classes. You only had a three-week period to get exposed to all of the different types of things. So I have a good groundwork for everything, but there's definitely a lot that I still need to explore on my own."

As for her own mentor, Greene’s favorite cooking show was “Cake Boss” as a kid, she said, though “no one really presented it as a career for me.”

“So when I was kind of in between jobs, I was like, what do I do? I’ve gotta figure something out. And I decided to apply to the CIA (Culinary Institute of America),” she said “And once I got in, I was like, well, we’re gonna really go for it then, all places, definitely, to really absorb as much as you can and learn as much as you can as well.”

Hours are 8 a.m. to 2 p.m. Thursday through Saturday.

She is working on the menu, which will be available, along with options for take-out, HERE.

Photos by Howard Owens.